Flood Insurance should be the easiest, most-straightforward type of insurance, but zones continually change and misinformation circulates like wildfire. When we have conversations about Flood Insurance we’re often met with responses like “I am not in a flood zone” or “I’m not required to have flood insurance” but the conversation can’t stop there. Every property is in some type of flood zone. And floods are the #1 natural disaster in the United States. With the average flood claim costing $30,000, we encourage everyone to have this added protection for their Florida property and personal belongings. We like to be sure that everyone who consults Harris Insurance for insurance advice is aware of the potential devastation of flooding that we face, especially by living in Florida.

What is a Flood Zone?

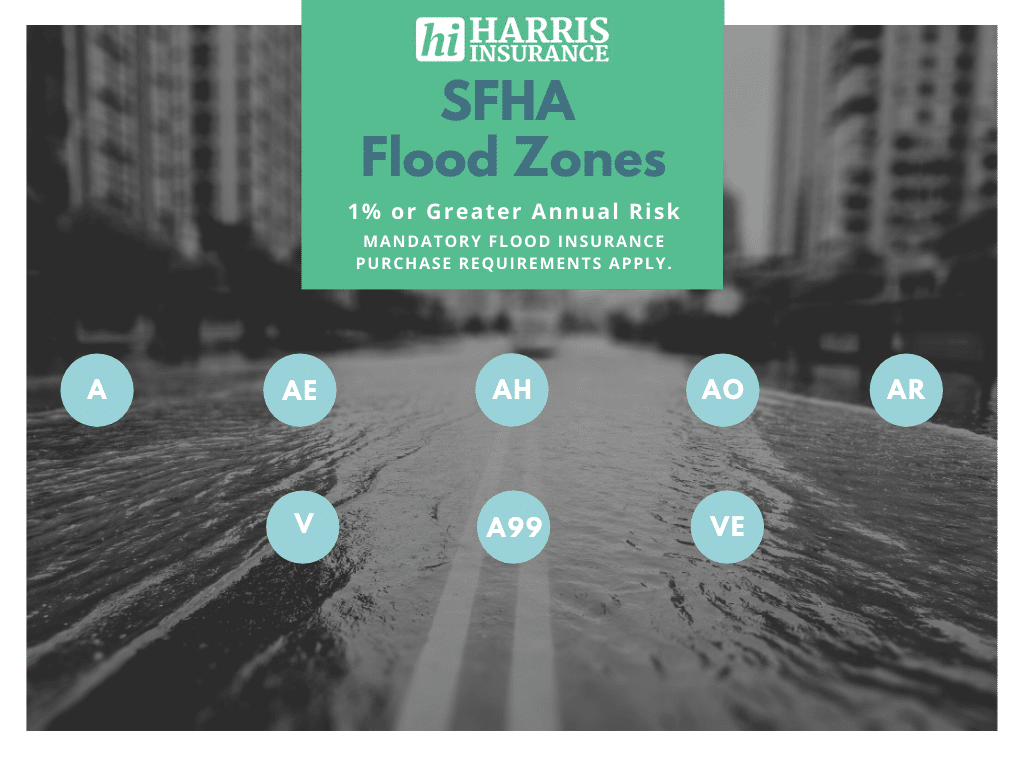

According to FEMA, Flood hazard areas are identified on the Flood Insurance Rate Map (FIRM) are identified as a Special Flood Hazard Area (SFHA). SFHAs have a 1% chance of flooding in any given year and are sometimes referred to as areas of “100 year flood.”

SFHA Zones include:

SFHA Flood Zones explained further:

- Zone A- Areas subject to a 1% or greater annual chance of flooding in any given year. Because detailed hydraulic analyses have not been performed on these areas, no base flood elevations are shown

- Zone AO- Areas subject to a 1% or greater annual chance of shallow flooding in any given year. Flooding is usually in the form of sheet flow with average depths between one and three feet. Average flood depths are shown as derived from detailed hydraulic analyses.

- Zone AH- Areas subject to a 1% or greater annual chance of shallow flooding in any given year. Flooding is usually in the form of ponding with average depths between one and three feet. Base flood elevations are shown as derived from detailed hydraulic analyses.

- Zones A1-A30- Zone AE is used on new and revised maps in place of Zones A1-A130.

- Zone AE- Areas subject to a 1% or greater annual chance of flooding in any given year. Base flood elevations are shown as derived from detailed hydraulic analyses.

- Zone A99- Areas subject to a 1% or greater annual chance of flooding in any given year, but will ultimately be protected by a flood protection system under construction. No base flood elevations or flood depths are shown.

- Zone AR- Areas subject to a 1% or greater annual chance of flooding in any given year due to a temporary increase in flood hazard from a flood control system that provides less than its previous level of protection.

- Zone V and VE- Coastal High Hazard Area. An area of special flood hazard extending from offshore to the inland limit of a primary frontal dune along an open coast and any other area subject to high velocity wave action from storms or seismic sources. All buildings should be elevated on piles or columns.

- Zones V1-V30- Zone VE is used on new and revised maps in place of Zones V1-V30.

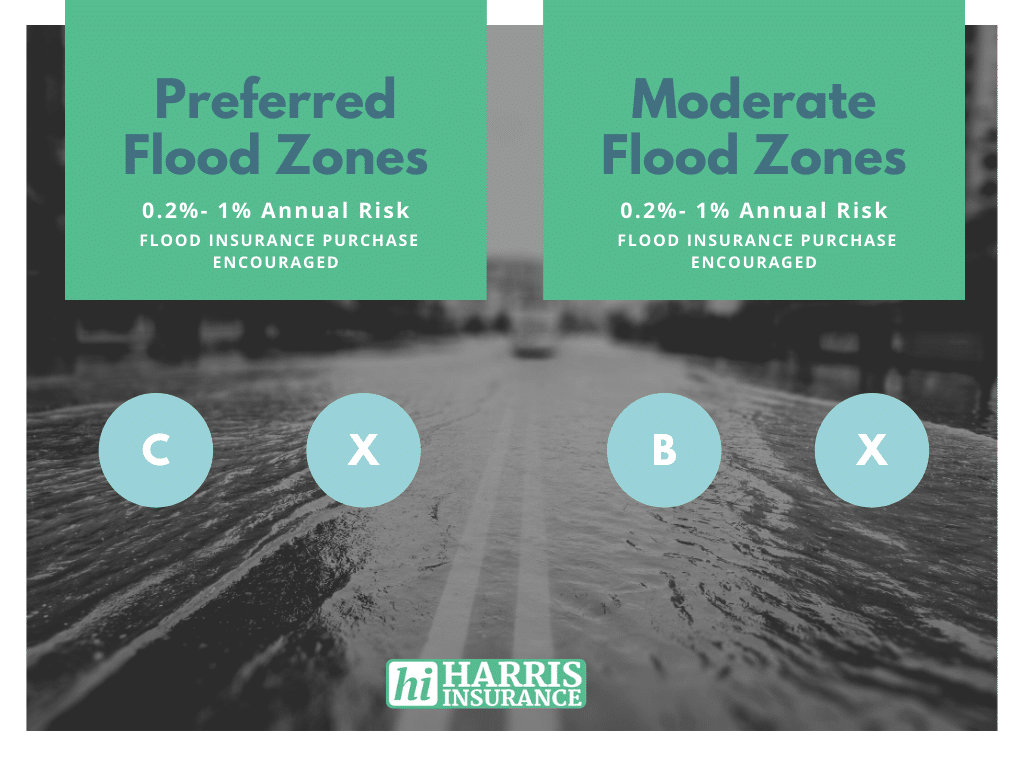

Moderate flood hazard areas are also shown on the Flood Insurance Rate Map (FIRM) and are the areas between the limits of the base flood and the 0.2% annual chance, sometimes referred to as “a 500-year flood.” Moderate Flood Zones are labeled by Zone B and Zone X.

The areas of minimal flood hazard, which are areas outside the SFHA and higher than the elevation of the 0.2% annual chance flood, are labeled Zone C or Zone X. These moderate and minimal zones are preferred and flood insurance is not required by federal mortgage programs, however, we still recommend acquiring flood insurance. We have learned from major storms in the past that even properties in these zones can flood, it just takes a certain magnitude of storm.

Preferred and Moderate Flood Zones include:

- Zones B, C, and X are areas of minimal flood hazard from the principal source of flood in the area and determined to be outside the 0.2 percent annual chance floodplain. (X is used on new and revised maps instead of C).

According to FEMA’s Website, Policyholders outside of high-risk flood areas file over 20% of all NFIP flood insurance claims and require one-third of federal disaster assistance for flooding.

It’s important to note that property owners in moderate-to-low risk flood areas are also eligible for lower costs on their “Preferred Risk (Flood Insurance) Polices.” It’s a no brainer to take advantage of lower rates AND add another layer of protection for your Florida Property.

Find out what flood zone your property is located in, visit FEMA’s Flood Map Service Center.

If you are a Florida Realtor and need a Free Flood Zone Determination for a property please put in your request on our Realtor Resources page.

Other Zones:

- Zone D- Areas of undetermined, but possible, flood hazards

Coastal Barrier Resources System

The Coastal Barrier Resources Act (CBRA) of 1982 removed the Federal Government from financial involvement associated with building and developing in undeveloped portions of designated coastal barriers. Essentially, this act was intended to discourage development in hurricane-prone ecologically sensitive coastal barrier areas, both to protect wildlife habitats and to help mitigate extreme losses. This Act made these areas ineligible for federal assistance as well as subsidized flood insurance programs like the National Flood Insurance Program (NFIP). Development can still occur in these areas, as long as private developers or other non-federal parties bear the full cost.

Properties can be completely or partially in a COBRA Zone which significantly affects flood insurance options for the property owner. The same lender requirements can still apply to the property, but whatever portion of the property belongs in the COBRA Zone can be expected to affect the price of the flood insurance premium.

Coastal Barrier Resources System’s (CBRS) boundaries are shown on maps that were originally adopted by Congress. With only a few exceptions, only Congress can change CBRS boundaries. The official CBRS maps are maintained by the U.S. Fish and Wildlife Service.

Do I NEED Flood Insurance?

A typical homeowners insurance policy does NOT cover flooding. Whether you live inside or outside of a high-risk flood area, the investment you have in your Florida properties deserves the added protection against flooding. Many property owners, particularly those in high-risk flood areas and those with government-backed mortgages are required to have flood insurance. Flood insurance is not federally required if you live outside of a high-risk area, however your lender may still require you to have a flood insurance policy. Harris Insurance recommends obtaining a flood insurance policy no matter what zone your property is in.

I’m renting. What do I need?

If you’re renting a property, we highly recommend a renters insurance policy but, like a homeowner’s policy, it doesn’t include flood insurance. It is likely that your landlord has flood insurance for the building, but that won’t cover your personal belongings. You can add an affordable contents-only flood insurance policy that will protect your furniture, clothes, electronics, rugs, artwork, and more in the event of a flood.

Your Flood Insurance Options:

The Flood Insurance industry has grown, changed, and vastly developed in the last five years. You now have three different options when it comes to Florida flood insurance:

- The National Flood Insurance Program (NFIP)

- Private Flood Markets

- Endorsements to your Homeowners Policy

You can learn more about your flood insurance options here.

Every property is vulnerable to flooding and you can’t expect federal disaster assistance to deliver in a catastrophic flooding event. Federal disaster assistance comes in two forms: a loan, which must be paid back with interest, or a FEMA disaster grant, which is about $5,000 on average, per household. By comparison, the average flood insurance claim in 2018 was more than $40,000 so $5,000 is not going to go very far.

Buy flood insurance today.

Give us a call at (850) 244-2111 or get your quote online:

LEGAL DISCLAIMER

Views expressed here do not constitute legal advice. The information contained herein is for general guidance of matter only and not for the purpose of providing legal advice. Discussion of insurance policy language is descriptive only. Every policy has different policy language. Coverage afforded under any insurance policy issued is subject to individual policy terms and conditions. Please refer to your policy for the actual language.