In a ‘normal’ insurance marketplace, Florida property insurance companies have 90 days to inspect and evaluate any business they receive and issue coverage on. During this initial 90 day “window” an insurance company can issue a cancellation and withdraw their offer of insurance protection for any reason they deem reasonable. This gives them time to qualify and verify the home meets their guidelines. They will drill down on the history of the home, view all the various reports, conduct their own inspections and review and make requests of the home owner for any issue or potential issue they feel may threaten the home. If any specific issue is found, it is common practice for the company to issue a notice of cancellation as a means of notifying the home owner of the issues or deficiencies it feels need to be resolved. It seems harsh to issue a notice of cancellation but consumer protection requirements as governed by the state, make ample notice of cancellation mandatory. During the time the notice is issued and the cancellation is effective allows for addressing the issue for resolution, if possible.

After the 90-day “underwriting window” has passed, an insurance company can only cancel a policy for cause (with notice) or non-renew a policy after the initial term has run its course. The term “non-renewal” means the insurance company will not offer a renewal policy beyond its current term. A non-renewal gives an insurance company an opportunity to divest itself of policies that no longer meet their guidelines or requirements.

It is important to note that non-renewals may be issued on a single policy or it could be for entire “blocks of business.”

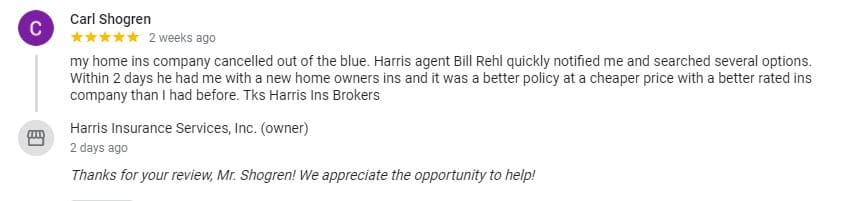

We shop every available market for your property and can help you replace coverage quickly & easily.

Insurance Companies must maintain adequate cash reserves to pay claims. These amounts are established and monitored by the Florida Department of Financial Services (FDFS). To add another twist to the mix, a company can fill the cash reserve requirement through the purchase of insurance which will pay or reimburse the company in the event of a catastrophic event or defined loss. The insurance an insurance company purchases for this purpose is called re-insurance. If a company finds itself “over extended” and needs to re-align themselves with the mandated requirements, they can either purchase more re-insurance to come into compliance, or reduce their exposure, which is to reduce the amount of insured value and number of policies. This may be accomplished through non-renewing policies they are insuring.

Whatever the reason, non-renewals are simply an ebb and flow of the insurance marketplace. It is important to discuss this matter with your Florida licensed insurance professional who can explain the underlying reason why, and most importantly offer you replacement coverage to keep you protected without any lapses in coverage.

The State of Florida is currently experiencing an abundance (over 30,000) of cancellations and non renewals. If your policy is being non renewed contact us today to see if we can help get your policy replaced quickly and efficiently.

Harris Insurance specializes in Florida Property Insurance and we would be delighted to assist you.

Is your insurance policy non-renewing or cancelling?

LEGAL DISCLAIMER

Views expressed here do not constitute legal advice. The information contained herein is for general guidance of matter only and not for the purpose of providing legal advice. Discussion of insurance policy language is descriptive only. Every policy has different policy language. Coverage afforded under any insurance policy issued is subject to individual policy terms and conditions. Please refer to your policy for the actual language.