We’re not talking about appraisals that value real estate, businesses, or collectibles by an authorized person. There is a different kind of appraisal, and you might not be aware that it even exists until after you file a claim and realize that this word was hidden in your policy.

An insurance appraisal is a provision found in the loss settlement section of many insurance policies and is intended to be another way to resolve disputes between an insurance carrier and policyholder. It is an alternative to a lawsuit, but unlike a lawsuit, the results are binding and cannot be appealed.

Insert Graphic

You can imagine, the authority this provision grants when invoked, given the broad scope of power an irreversible result it grants. In a perfect world, where both parties are reasonable and working towards resolving a matter, it seems equitable to have a final binding resolution process. Unfortunately, we all know where authority is given, it can be abused and in extreme instances, even dishonest behavior can be mistakenly incentivized.

Initially the claims Appraisal process was to determine the amount of loss only. However, as the implementation of Appraisal as a dispute resolution has grown, it has naturally expanded beyond the loss and cost of the damage, to also determining the cause and causation. So much so, that some States have now started to look into restricting the role of the Appraisal provision.

It may seem I am bashing insurance companies, but I am not. Most insurance company’s positions are to always do what is best for their policyholder. But many only engage Appraisal in rare instances and some do not have it in their policy language at all. Company claims departments are made up of people from all backgrounds, experience and education levels who are trained to make decisions and are capable of making bad decisions at any given time. Once a demand is made, I do not know if it is ever withdrawn.

In my professional opinion, I feel the benefit to having an Appraisal provision in an insurance contract is so small, that it should be removed. The method for determining the amount of a loss has historically been rather simple, either Actual Cash Value, (ACV) or Replacement Cost (RC). One of these valuations are agreed to by both parties before any loss has occurred. However, for a carrier to disagree with the cost of a loss after it has occurred seems at best disingenuous.

Adding replacement cost (RC) to a policy almost always comes at a steep additional cost. This additional cost is agreed upon and paid by the policyholder. And replacement cost has an easily understood definition as the cost to replace the damaged structure or item. Even after purchasing this option, most insurance carriers only initially pay ACV value and “hold-back” the full RC payment until “Replacement” is proven. This “hold-back” practice, I also strongly disagree with and will address separately, but nonetheless, it is a standard provision and ultimately the full RC value makes its way to the policyholder.

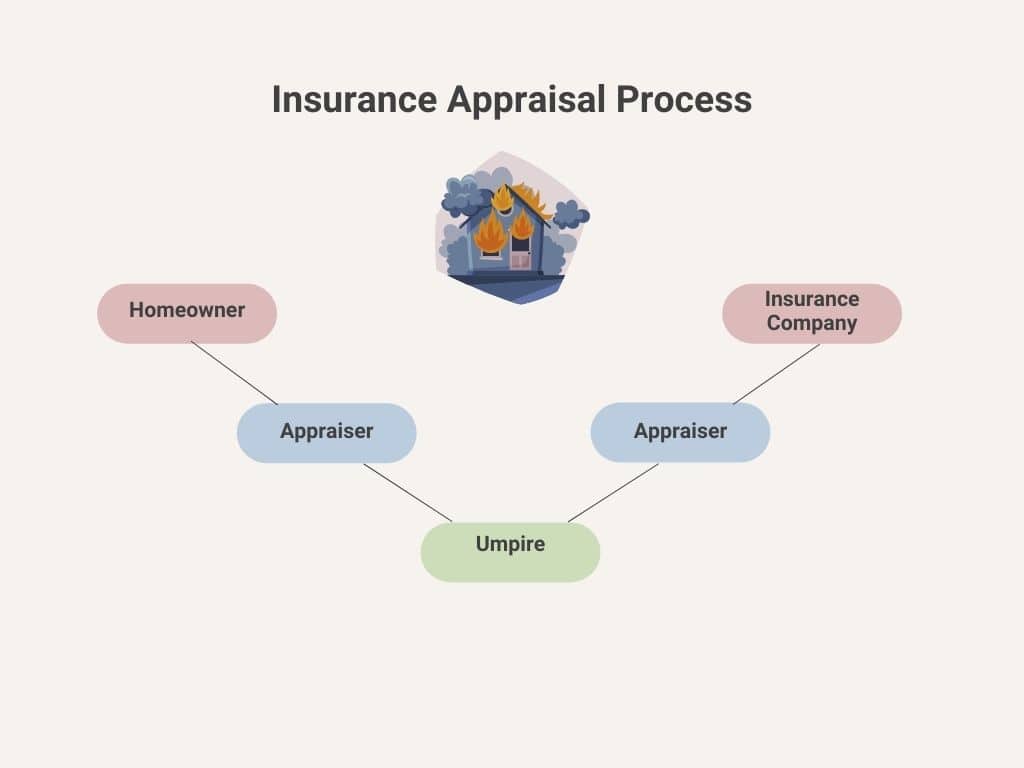

The terms “Appraisal” and “Mediation” are often referenced together, I guess to take the edge off what “Appraisal” actually entails. Appraisal is not mediation. The process starts off this way, and both parties pay for their own representation, and even share the cost of the third “umpire”. The umpire has the final word and in the case of an impasse, can introduce the result. It does not require an agreement.

This is why the process rarely ends well for the policyholder. And we’ve established that whatever is determined in the appraisal process is final and there is no second chance, legally or otherwise.

So what seems to be a fair way to resolve a dispute at first, turns out to be not fair at all. The entire process is weighted towards the benefit of the insurance company. Recognize insurance companies do this all day, every day and have the ongoing relationships with the mediators and adjusting firms. They set the rules, introduce all the administrative criteria, methodology, supporting documentation, studies and even case law, leaving the policyholder effectively thrown to the lions, even with the best representation, substantiation and re-creation of documentation to they can muster.

You can now imagine that while “Appraisal” does serve to close cases and break impasse, it also encourages premature demands. If the carrier wants to argue about the costs of repair, what is there to lose? This incentivizes bad behavior. And can you imagine about situations where claims are outsourced, and the retention or bonus of the outsourced company is determined by how much cost they can demonstrate they saved the company?

It is argued to be fair because either party can make the demand for “Appraisal”. And, it would be interesting to know the statistics for how many times Appraisal is chosen or demanded by an insured verses an insurance company. In my mind, this statistic alone would help to demonstrate how fair this option as a means of settlement, actually is. I do not know this number, but I am sure it is very low.

Again, in my opinion, I really do not see any benefit to a consumer for this provision in an insurance policy and I hope all State’s take steps to introduce legislature to restrict it or remove it as a settlement option altogether.

If you find yourself in a similar predicament, be sure to tread cautiously and ensure you take every precaution to protect your best interest. You can be sure the other side will and there is no second chance.

LEGAL DISCLAIMER

Views expressed here do not constitute legal advice. The information contained herein is for general guidance of matter only and not for the purpose of providing legal advice. Discussion of insurance policy language is descriptive only. Every policy has different policy language. Coverage afforded under any insurance policy issued is subject to individual policy terms and conditions. Please refer to your policy for the actual language.