Our Best Friend, the Hurricane!

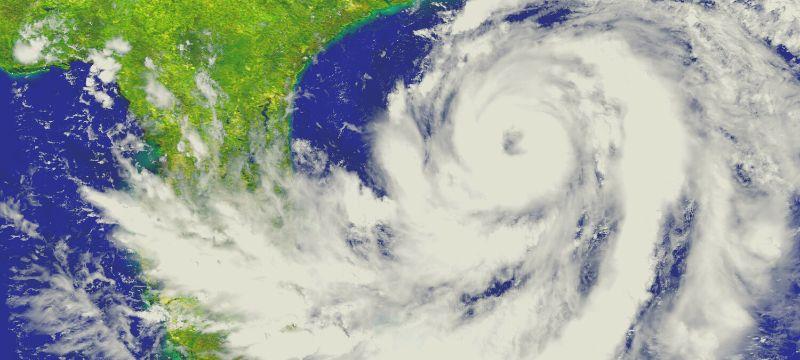

Let’s talk about hurricanes! As we all know, hurricanes are one of the most powerful and destructive natural disasters on Earth, shocking right? They are formed when warm, moist air over the ocean rises and cools, forming clouds. As the clouds continue to grow and the wind patterns change, a tropical depression can form, which can then develop into a tropical storm and eventually a hurricane. Since Florida is located in the tropics, the most active hurricane area of the world, it only makes sense for us to inform everyone from natives to newbies on these storms!

Hurricanes are dangerous because they can cause strong winds, heavy rain, storm surge, and flooding. The winds can knock down trees, power lines, and buildings, while the rain and flooding can cause extensive damage to homes, cars, and other property. In addition, hurricanes can spawn tornadoes, which can add to the destruction. More on tornadoes another day. Surprisingly, both of these natural disasters coexist around the state and they are a deadly pair.

So how can you prepare for a hurricane?

First, it’s important to stay informed about the storm by listening to weather updates and evacuation orders from local authorities. You should also have a plan in place for your family, including a designated meeting place and an emergency kit with food, water, first aid supplies, and other essentials.

If you live in a hurricane-prone area like the Florida coastline, it’s also important to make sure your home and car are prepared. This can include things like reinforcing windows and doors, securing outdoor furniture and other objects, and trimming trees and branches that could fall on your property. You may also want to consider purchasing a generator, as power outages are common during hurricanes.

One of the most important steps you can take to protect your property during a hurricane is to have adequate home and auto insurance. Homeowners insurance can help cover the cost of repairs or rebuilding if your home is damaged or destroyed by a hurricane. Similarly, comprehensive auto insurance can help cover the cost of repairs or replacement if your car is damaged by a hurricane or flooding.

But it’s not just about having insurance – it’s also important to understand what your policy covers and what it doesn’t. For example, most standard homeowners insurance policies don’t cover flood damage, so you may need to purchase a separate flood insurance policy if you live in a flood-prone area.

You should also review your policy regularly and make sure you have enough coverage to protect your property and assets. Harris is here to help with that!

Now, let’s talk about staying positive during stressful situations regarding hurricanes. It’s easy to get overwhelmed and anxious when facing a hurricane, but it’s important to remember that you’re not alone. Reach out to friends and family for support, and take time to practice self-care and relaxation techniques like deep breathing or meditation. Remember, you’ve taken steps to prepare for the storm, and you’re doing everything you can to protect yourself and your loved ones.

While hurricanes are a serious threat, proper preparation and insurance coverage can minimize the damage and protect your property and assets. Stay informed, have a plan in place, and stay positive – you’ve got this!

Be on the lookout! We are in the process of making our 2023 Harris Hurricane Handbook! We will give you more information on it soon!

We are here to help answer any questions you may have when it comes to all things insurance and weather! Drop us a line at service@harrisinsurance.com or call us at 850.244.2111

LEGAL DISCLAIMER

Views expressed here do not constitute legal advice. The information contained herein is for general guidance of matter only and not for the purpose of providing legal advice. Discussion of insurance policy language is descriptive only. Every policy has different policy language. Coverage afforded under any insurance policy issued is subject to individual policy terms and conditions. Please refer to your policy for the actual language.