Before we jump in to litigation and how it affects your Florida insurance policy rates, let’s hit the basics:

- An insurance policy is a legal contract

- Litigation is defined as the process of taking legal action. More and more, this is becoming the common solution for any dispute or disagreement in the fulfilment of the contract to resort to litigation to determine the proper resolution. Everyone wants what they’re owed, but when we factor in the costs of litigation, it contributes to rising rates.

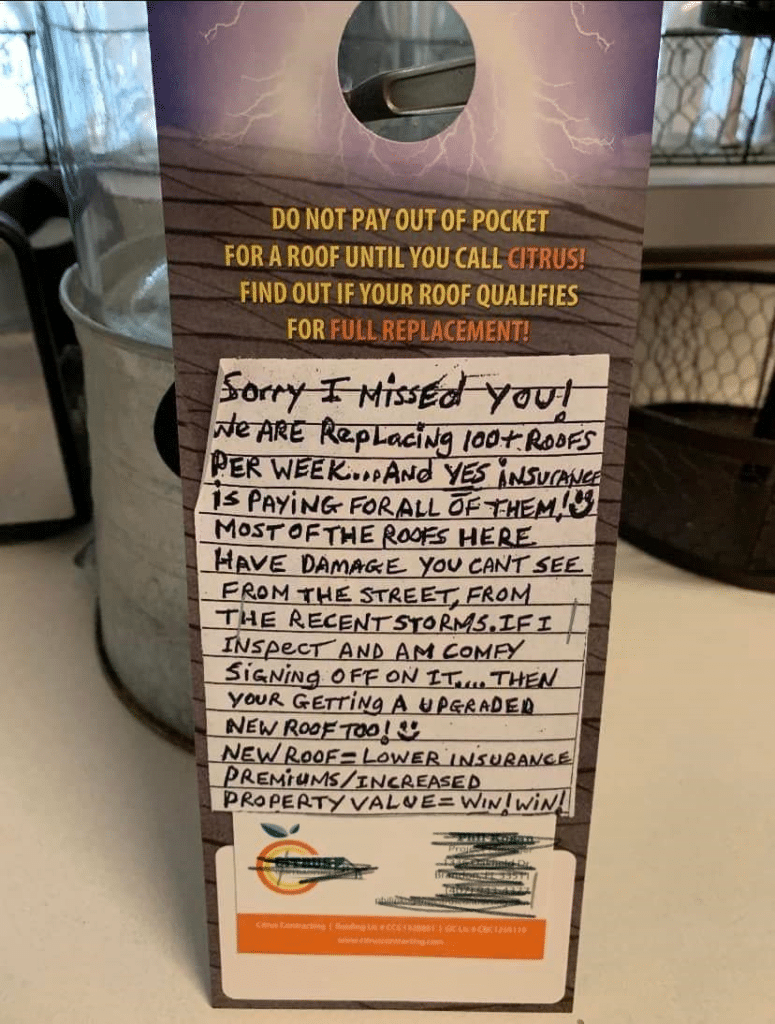

- Florida’s litigation numbers in one month are higher than the rest of the nation combined for an entire year. Below is an advertisement from one roofing company soliciting new roofs throughout the state just this year. (Source: Johnson Strategies, LLC: Planning, Communications, Advocacy).

New roof without an out of pocket expense? What’s the problem? Some people have turned their careers into profiting from other people’s claims and it’s wrong. Insurance is designed to assist people after a sudden and accidental event. It is not designed to upgrade everyone’s wear and tear. If you have fallen for something like this before, you might not have known or understood that your roof was not “free.” Instead, add this to the debt of the insurance companies who now have to charge ALL insureds more to be prepared to answer more potential claims PLUS the cost of litigation.

Litigation Costs Us All

Legal action can be expensive for both parties so, generally speaking, nobody wants to incur the time or cost of having to file a lawsuit or go to court. If they do embark down this path, usually there are several attempts to reconcile long before a case ever gets to trial. These negotiations prior to the actual trial are attempts at mediating the differences between the parties (See my blog on Mediation verses Appraisals – motivating bad actors) and actually, many contracts expressly call for these attempts to mediate the dispute before parties are eligible to continue onto trial. Florida is one of the States where a large effort is required to be made before parties are eligible to go to court. Yet, despite all these efforts and contractual obligations, it is clear that Florida has an insurance litigation problem.

To demonstrate how big of a problem, I will share a shocking and telling statistic. The State of Florida is large, but not the biggest State by a long shot. We rank # 22 of all the States in the Country by land area. By population, we rank #3, behind California and Texas. In measuring the number of insurance claims Florida contributes to the entire Country, we make up less than 10% of all insurance claims. Yet, a 2019 study by the Florida Department of Financial Services found that Florida is responsible for more than 80% of the entire Country’s Homeowners insurance litigation.

Florida has a lot of challenges, it is understandable that a State in the Tropics, jetting out between the Gulf of Mexico and the Atlantic Ocean suffers from more than its fair share of Hurricane exposure. Yet, anytime you measure 10% of anything contributing to 80% of a problem, it clearly identifies deeper problems.

And there are.

The parties to the Florida Insurance Contracts are not agreeing in how they should be honored. They’re not successfully negotiating (mediating) and they are going to the courtroom with each other over what each feel is fair.

There cannot be one answer to this or it would have already been resolved. And honestly, I don’t pretend I could know what the answers are. But I can say that both insurance companies and consumers are responsible for this predicament. In my opinion, insurance company’s changing or burying contingencies in policy language, forcing post-loss actions on consumers, and introducing new ways to pass losses onto consumers in an effort to lower costs, is not the answer. And, coverage limitations and claim payment hold-back provisions rarely benefit companies. Actually, they usually spur the wrong results.

With this said, the Florida insurance industry is not inherently bad. In fact, the industry frequently makes decisions to benefit consumers. In 2004 after four Hurricanes stuck the State in a span of six weeks, the insurance industry universally took the position to only apply the deductible only once. They were not required to at the time but this position was the right thing to do and it saved many residents their homes. There are many untold similar instances and it is rewarding to hear of these when they occur.

And of course, it is important to recognize that not all claims are legitimate. Some are inflated, exaggerated, and some are limited in their coverage or excluded altogether and should not be payable at all. Maintenance issues are a good example of this.

Always be your own Advocate

The third party to blame is your Insurance Agent. Or lack thereof. New, direct companies are soliciting Homeowner or Auto Insurance Policies in five minutes online and can save you hundreds! I would be very weary of what you are sacrificing when you sign up for something like this without reviewing it with a licensed professional. The anonymous nature of never being able to speak to the same Agent again or hold them accountable for what they tell you is a recipe for disaster and is financially dangerous.

I wish I could tell you that all Agents are honest, knowledgeable and reputable. But I know not all are, as I see quotes & proposals where either intentionally or unintentionally, coverage is reduced or eliminated completely, just to make their lower offer look appealing & make a sale. We’ve even seen policies that are completely different forms than what the insured thought they had. It’s crucial you make sure that you are dealing with a reputable, Independent Insurance Agent who will look out for your best interest, regardless if it results in a sale.

I’ve highlighted some of the issues and what is clear is that Florida Insurance Companies must find a better way to quickly respond, limit further damage, pay and close these claims, rapidly. Increased insurance company inspections requirements are helping but marginally. Insurance Agents must do a better job of explaining issues to clients instead of cutting corners to get policies down to the best rate. And insureds need to truly evaluate what they file as claims instead of cashing in on scams.

Allowing homes to sit in disrepair for months or years while disputes are settled is not reasonable in the same way that paying for inflated repairs are not reasonable.

There is a saying that when you go to court, everyone loses.

When it comes to Florida Property Insurance, this is proving true. And when we incentivize bad behavior on any side, it may just be the path that is chosen.

LEGAL DISCLAIMER

Views expressed here do not constitute legal advice. The information contained herein is for general guidance of matter only and not for the purpose of providing legal advice. Discussion of insurance policy language is descriptive only. Every policy has different policy language. Coverage afforded under any insurance policy issued is subject to individual policy terms and conditions. Please refer to your policy for the actual language.