Request your quote for Lakeland FL Life Insurance:

Life insurance may sound like something you don't need to consider right now, and yet, it is as important as all other insurance policies you have. Your most important priority is your family and if something should happen to you, you want to know they are fully protected. At Harris Insurance, we have all the answers you may be seeking all about life insurance.

Considerations for Life Insurance

When is a good time to buy life insurance? Is it really for me? Should I wait or buy life insurance now? Our Lakeland life insurance agents hear questions like these every day.

Why Do I Need Life Insurance?

Life insurance is intended to protect your family, should you pass away unexpectedly. Life is guaranteed to no one. Accidents, illnesses, disease, and tragedies befall people every day. The loss of a loved one is devastating and no one wants to go through it, but almost everyone will. To help be prepared, it's important to contact our Lakeland agents about life insurance quotes.

Life insurance will cover the costs of a funeral and we all know how expensive they can be. Funeral costs have skyrocketed in the last decade and life insurance is a good buffer against these rising costs. Life insurance does more than that; it provides a way for your family to keep going, to pay off the mortgage, to see your children through college, and to keep enjoying their present standard of living.

A good life insurance policy will:

- cover end-of-life expenses

- give you peace of mind

- let your family move forward comfortably

- avoid debt and added financial strain

When is a good time to purchase life insurance?

Whether you are married with a family or still single, now is the time to purchase life insurance. You may be waiting to get married or start a family, but the sooner you buy life insurance, the better for you. In fact, the younger you are, the better life insurance you will be able to procure.

It's known as your insurability and it decreases the older you get. Insurance companies will charge you more money if they know you are on certain types of medications or if you have had any kind of health issues over the years.

Purchasing life insurance is a good way to go. In fact, you may want to purchase a little bit more than what you think you need. If in future, you want to reduce that life insurance benefit, it's easier to do that than to try and increase your life insurance once you are older.

As Florida’s trusted choice for Life Insurance, we offer:

Term

Annual renewable term

Level term, specified amount guaranteed not to change for a specific period of time.

Key man life insurance

Mortgage Protection

Second to die

Critical Illness: Cancer, Heart Attack, or Stroke Insurance

Options and Discounts:

There are many riders and options that can be incorporated in a life policy, please discuss your desires and concerns with one of our Florida licensed experts today.

What types of life insurance should I consider?

Whole Life Insurance

Whole life insurance is what is known as a permanent life insurance coverage that locks in benefits for your end-of-life expenses and provides protection for your family. It is also a good idea for the cash value you can utilize in the event of an emergency. There is generally guaranteed acceptance between the ages of 45-85.

Whole life insurance is good for you if:

- you need coverage that doesn't require a medical exam or many questions

- you would like to supplement an existing policy

- when you are looking for funeral expenses or ways to pay off final debt

- you are on a fixed income or a tight budget

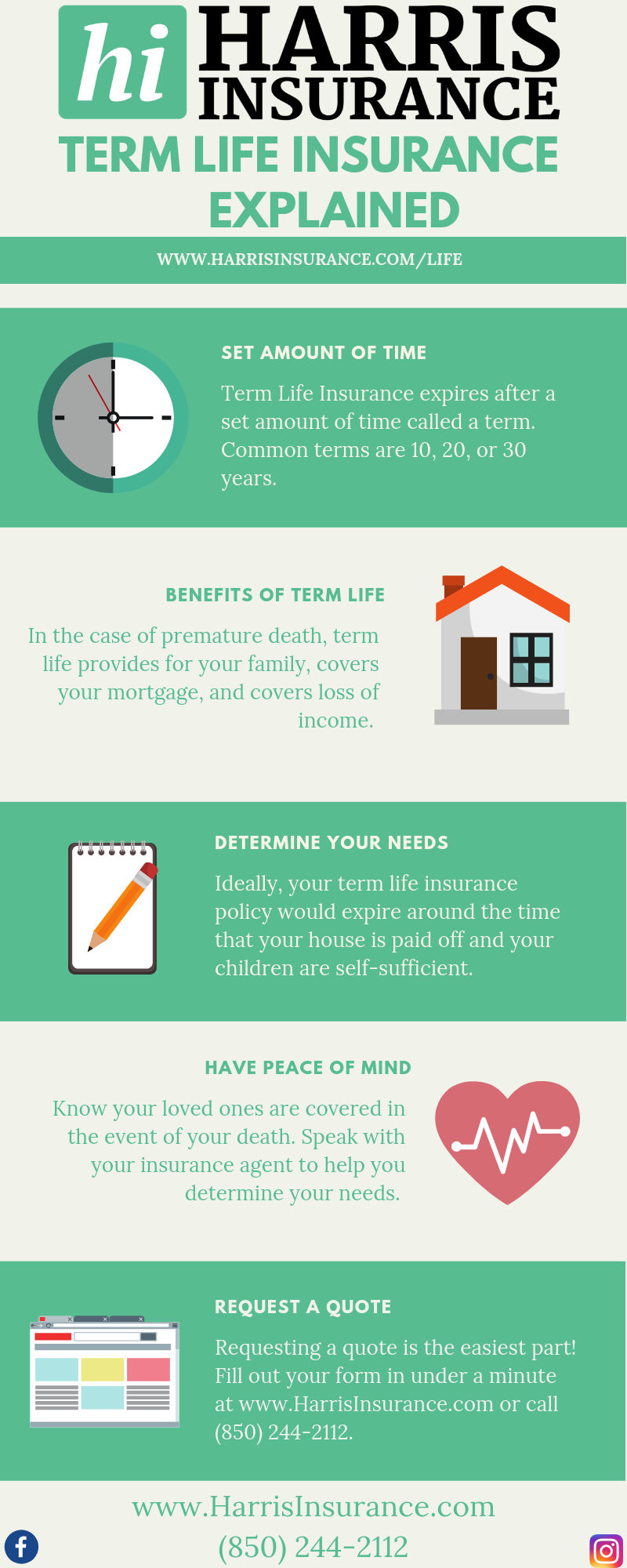

Term Life Insurance

Term life insurance is a great fit for anyone looking to have a life insurance plan for a specified period. You determine for how long you will have the policy. Your payment is always the same month-to-month and you are always protected.

Term life insurance may be for you if:

- you want to protect your family even when you're no longer around

- you need coverage you can afford for a specific period

- you are looking for additional coverage, such as when your children are growing up

- you want to cover debt such as paying off credit cards or a car loan

If your term life insurance policy expires, you are given the option to renew. You can keep term life insurance all the way up to age 95. Policy issue ages are between 18-80 and you can convert a term life plan into a permanent life insurance plan.

Universal Life Insurance

With a universal life insurance plan, the premiums and benefit amounts are flexible, and you can change up your policy later in life, if your needs change. With a universal life insurance policy, you have the option of building cash value on a tax-deferred basis.

Universal life insurance is something to consider if:

- you are looking to create a death benefit that will protect your loved ones

- you are willing to accept flexible payment amounts and their frequency

- you are looking for cash accumulation for things such as college expenses

At Harris Insurance, our expert life insurance agents in Lakeland will help you. We love assisting all our customers by:

- developing their goals

- giving them the options that they may not know about

- recommending solutions for all their needs

- implementing a life insurance policy that works for them

- answering all their questions thoroughly

When looking for Lakeland life insurance companies, don't look any further than Harris Insurance. We provide all our customers with the best in life insurance options every day – policies that are tailored for you and your family, to give you the financial security you need. Our licensed experts will answer any and all questions you have about which life insurance is best for you.

We want you to feel confident in the policies you purchase from us. We provide a whole host of insurances for our customers, everything from auto, homeowner's, business, boat, flood and more. If you live in Lakeland, request a quote from us or contact us today to get the life insurance you have been putting off for too long. Let us know how we can help you.