Request your quote for Lehigh Acres FL Life Insurance:

Life Insurance Coverage in Lehigh Acres, FL

There are many different types of insurance you can purchase in your lifetime. Everything from mortgage insurance to auto insurance, homeowners to flood insurance, but perhaps one of the most important types of insurance is life insurance. If you value your loved ones, strongly consider purchasing a Lehigh Acres life insurance policy.

Let’s face it, death is a definite in life, but properly handling this part of life is something we are all bad at. We rarely handle it well. However, making it easier on our loved ones after we depart is one of the most important things we can do. Did you know that 1 in 3 households have immediate trouble paying living expenses, after the primary wage earner passes? There are all kinds of ongoing, life expenses that arise and cause stress on your loved ones.

When you purchase life insurance, you are providing a safety net for your loved ones for when you pass away. A life insurance policy is a contract, and as long as the policy is active and the premiums are up to date, it will provide a death benefit payout to whomever you designate upon your death.

A life insurance benefit is one of the only ways to transfer money to your family, tax free which is why it is used for estate planning as a powerful financial tool.

A life insurance benefit can be used however you wish. Beyond the day to day expenses, some life events that come to mind include things like paying college tuitions, weddings, paying taxes, paying off mortgages or debt of any kind, as well as funeral expenses or anything else that the family may need. Life insurance policies vary and if you are looking into such a policy, contact our team of experts at Harris Insurance who can give you a variety of Lehigh Acres life insurance quotes.

Types of Life Insurance in Lehigh Acres FL

Life insurance has never been more affordable for you and your family. Life insurance provides financial stability in the event of your death. Just as there are many types of insurance, there are also many types of Life Insurance. For example, Burial Insurance provides specific amounts to assist in last services. Supplemental or Excess Life Insurance offers additional coverages over limited amounts available through work or other owned policies. Second to Die Life Insurance pays out upon the passing of the second named insured or if both parties pass simultaneously. Key-Person Life Insurance protects businesses from the loss of an executive partner or to guarantee re-payment of a business loan. Mortgage Life Insurance pays off specific schedules and amounts pertaining to loans.

Many of these are variations of Term or Permanent Life Insurance Policies. That is why at Harris Insurance, we can provide you with the premium protection you need now. Our licensed experts will speak with you about the different types of life insurance available to you and help you to choose what is right for you. We can help.

As Florida’s trusted choice for Life Insurance, we offer:

Term

Annual renewable term

Level term, specified amount guaranteed not to change for a specific period of time.

Key man life insurance

Mortgage Protection

Second to die

Critical Illness: Cancer, Heart Attack, or Stroke Insurance

Options and Discounts:

There are many riders and options that can be incorporated in a life policy, please discuss your desires and concerns with one of our Florida licensed experts today.

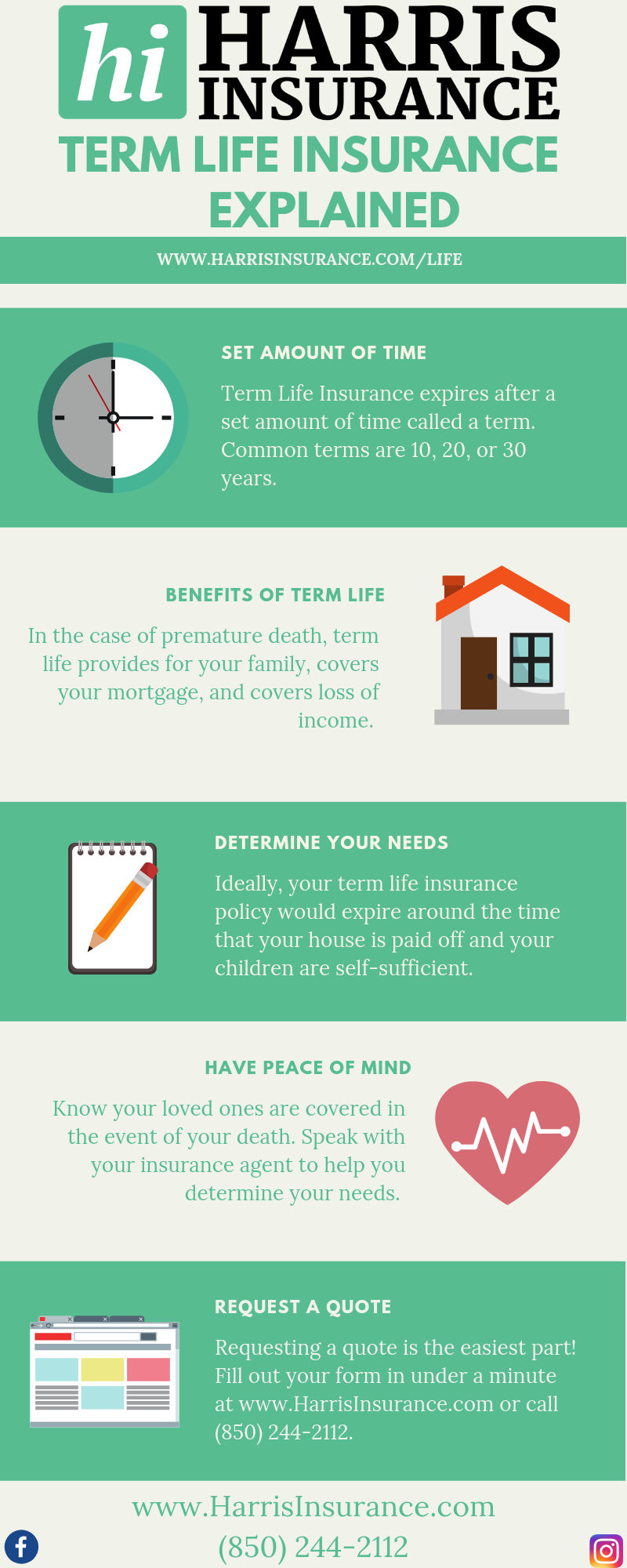

Lehigh Acres Term Life Insurance

Term Life Insurance is valid for a certain term or time period. It provides protection to your family upon your death, if it occurs while the policy is in force. Term life insurance quotes do vary and that is why you will want to talk about the best length of time for you. You can lock in rates for a period of time: typically 10, 20, or 30 years and the cost will not change until the end of the selected term, and you are offered to continue coverage for another select number of years. Speaking with one of our agents about term life insurance will give you all the answers you are seeking.

Why should you look into buying Term Life Insurance? For many reasons, the most common being that Term Life Insurance has lower costs than other life insurance policies. If you are a non-smoker and in your 20s, your premium will be a lot lower than for someone much older with underlying health issues. Once a life threatening illness is diagnosed, life insurance of any kind becomes very difficult to obtain, if not impossible to secure.

The younger you are when you initiate your Life Insurance Policy, the more coverage you can afford to purchase because costs are low, which means more protection for your loved ones. You can purchase a policy for as little as one year, although the most common options are 10, 15, 20 and 30 years. Once you determine how much coverage you want, your premium can remain fixed throughout the length of the policy and it’s smart to lock in rates for as long as you can!

Lehigh Acres, FL Whole Life Insurance

Whole life Insurance can also be thought of as Permanent Life Insurance, one which provides lifelong coverage with a guaranteed rate of return and premiums that are typically locked-in as long as the policy is active and paid on time.

As you compare Lehigh Acres, FL whole life insurance quotes, keep some specifics in mind as two factors are very important: the cost of the whole life insurance premium and the expected growth of the policy's cash value. When you contact us about whole life, we will help you choose a policy that fits your specific needs.

In a whole life insurance policy, your premium is split. One part goes into a cash value account, and the rest covers the life insurance costs of your policy. Over time, your cash value will grow, and you will have the option of borrowing against it, as long as you continue to make your monthly or annual premium payments.

Why choose Whole Life Insurance? For many reasons, actually. A Whole Life Insurance policy has no set limit, as it lasts until the policyholder officially passes away. Your Lehigh Acres Whole Life Insurance policy continues to build tax-deferred cash value over the life of your policy, and your premium payments are always the same, year over year.

Let Harris Insurance Guide You to Your Best Life Insurance Coverage in Lehigh Acres

When looking for a life insurance policy that is best for your family, do not face it alone. Harris Insurance is here to help you find and understand the best-possible life insurance options for you and your family. Our Lehigh Acres Life Insurance Agents can provide you with premium protection for your family. Whether that is in the form of Term Life Insurance or Whole Life Insurance, we explain the benefits and options as well as coverage levels, so you know how to make the right choices for you.

When it comes to Florida Life Insurance, make sure you select an Agent who has your best interests at heart. Harris Insurance has been protecting Florida Residents since 1965 and our Licensed Agents continually grow and develop their understanding of types all insurance on a daily basis. We are your trusted source for Florida Life Insurance, so contact us today to get started on your life-long protection.