Flooding is the most common and costliest natural disaster in the United States.

Did you know that the #1 natural disaster in the country is flooding? Flooding is widespread and destructive. Whenever heavy rains threaten our area or storms are on the horizon, you want to feel as protected as possible. Now you can with Punta Gorda, FL flood insurance coverage from Harris Insurance.

Flooding happens in every state, yet Florida is one of the main states for them to occur. Due to the low-lying terrain, and the tendency for hurricanes and other heavy rainfall, there is always someplace in the state that is experiencing flooding. Do your research on Punta Gorda, FL flood insurance companies to protect you the way you want to be protected.

Harris Insurance will help you receive the ideal coverage you need for flood insurance in Florida. Because everyone is in a "flood zone," the coverage you need depends on what type of flood zones your property is located. Flood zones are also continually changing so you need a company that is on top of what is happening.

What is Flood Insurance?

Many Floridians make the mistake of believing their homeowner’s policy has them covered for flood damage. This is generally not the case. A standard homeowner’s policy does not cover damages caused by floods. To protect yourself and your property, a separate flood insurance policy is needed.

Our Punta Gorda, FL flood insurance coverage is for everyone, everywhere. FEMA has reported that up to 25% of all flood claims come from people who are living in moderate to low-risk areas for flooding. You never know when a flood could happen, and living in Florida, your risk is greater than in other areas.

At Harris Insurance, we have access to over ten private markets with more coming on board every day. That adds up to significant savings that are passed on to our customers. Not too long ago, the only way you could be insured for flood damage was through the National Flood Insurance Program (NFIP). Now, more private companies have come on board.

Living in Florida Means You Need Flood Insurance

According to the NFIP, 8 out of 10 households are not covered by flood insurance. That is not a good statistic, but you as a homeowner can do something about it.

If you live in Florida, here are some reasons you need flood insurance:

- Florida's terrain is mostly flat, and the entire state sits at a low elevation, which means when floodwaters come, they tend to spread out far and wide.

- Florida has over 8,400 miles of coastline between the Atlantic Ocean and the Gulf of Mexico. Rising tides mean many people are at risk of flooding.

- If you live in Florida, then you know we always have more hurricanes than any other state.

Why Should You Buy Flood Insurance?

You have seen the pictures, or maybe you have had to live through it personally. People wiped out from water in their homes so high that everything must be thrown out. Flood damage is devastating, and your homeowner’s insurance will not cover your losses. Therefore, it is so important to obtain a Punta Gorda, FL flood insurance quote from Harris Insurance. It is fast, it is easy, and you will be pleasantly surprised as to how affordable it is.

The importance of carrying flood insurance should not be underestimated. Whether you live in a flood zone, which mandates that you carry flood insurance, or are in a flood zone where doing so is optional, every property in Florida should carry flood insurance.

98% of US counties have experienced a flooding event. From 2014-2018, all 50 states have experienced losses due to flood or flash flood.

The average cost of flood insurance is $53 a month. If you live in a low-to-moderate risk area, your premium could be even lower!

| National Flood Insurance Protection | Coverage | Coverage | ||

| Owner occupied | Building | Contents | ||

| $371 | $100k | $40k | ||

| $389 | 125k | 50k | ||

| $415 | 150k | 60k | ||

| $453 | 200k | 80k | ||

| $480 | 250k | 100k | ||

Obtaining Flood Insurance in Punta Gorda Through Harris Insurance

We have all seen the power of water and what it can do. Even if your property is inundated, it is still a comfort knowing your flood insurance will cover your losses. Flood insurance in Florida is a must.

Therefore, it is so important to contact us today to discuss your options. At Harris Insurance, we understand flood insurance and work with you so you can have the coverage you require. If you are in a Special Flood Hazard Area (SFHA), you will require an elevation certificate. This means a licensed property surveyor will inspect your property to provide you with the most accurate flood insurance quotation for your home and property.

You absolutely need to know if your home is at risk of flooding. Many factors play into how we determine the cost, and we are happy to answer any questions you have about obtaining Punta Gorda, FL home flood insurance.

Disasters are inevitable but being prepared is optional. Ninety-eight percent of US counties have experienced a flooding event, and there is always a season for floods in Florida. You can quickly and easily request a quote from us by touching base with us today. Our quotes are always free and contacting us can be your first step toward greater peace of mind. In a flood situation, you already have enough to worry about, let Harris Insurance worry about the cost.

Check Out the Details

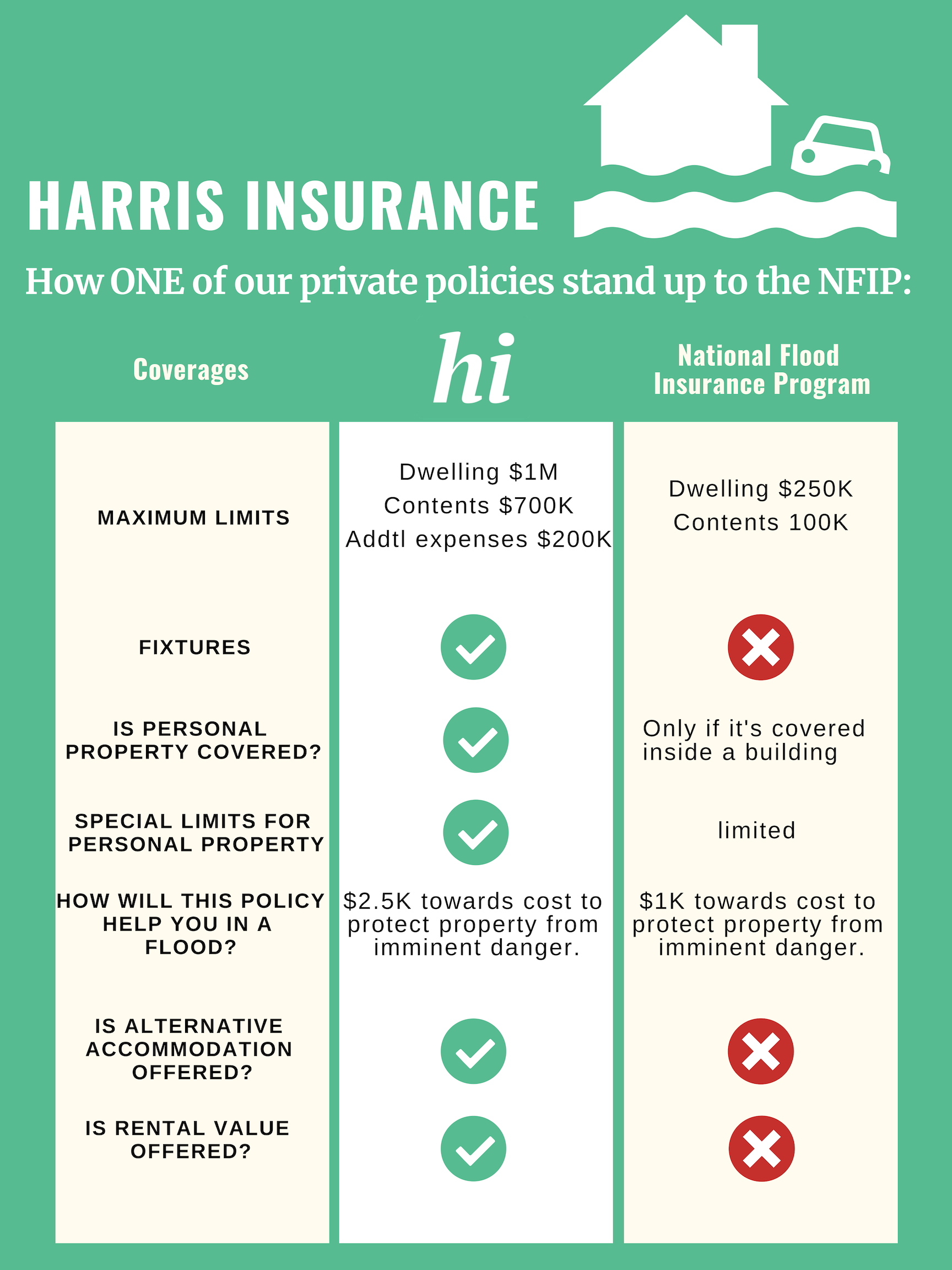

Here’s how just ONE private policy compares to the National Flood Insurance Program:

If your property is at risk for flooding, you need to know. You also don’t want to pay more than you have to for flood insurance. A Flood Elevation Certificate assesses your property’s flood risk and, depending on the findings, enables you to pay a lower premium for flood insurance.

As the trusted choice for Florida flood protection, we offer:

- Business Property coverage

- Business Contents coverage

- Residential Property coverage

- Residential Contents coverage

- Optional excess flood insurance for coverage limits above the FEMA federally subsidized program