Flooding is the most common and costliest natural disaster in the United States.

When you think of the number one natural disaster in the US, you might be surprised by what sits on top. The answer is flooding. Flooding has the power to destroy buildings and the possessions within. It is potentially lethal and can elevate the risk of disease. It is not only destructive but also widespread, which is why you will benefit from the peace of mind and protection from flood insurance in the Sarasota area.

To counteract the destructive power of flooding, we recommend that you touch base with Harris Insurance to talk about our high-quality Sarasota, FL home flood insurance, because not all flood insurance is the same. Everywhere in Florida is classified as a flood zone, and the coverage you will require depends on the type of flood zone on which your property is located. Also, if you have not updated your knowledge on flood zone changes recently, you can rely on our experts to give you the current status and provide you with the appropriate flood insurance coverage.

Many people who experience flood damage are not living in a high-risk flood zone. Even if your area is not listed as high risk, it is wise to make sure you are covered for flood damage. According to FEMA, a quarter of all flood claims come from people in moderate to low-risk areas. If you are living in Sarasota, why take the risk of living without flood insurance? Contact us for expert advice and peace of mind.

Why Do We Need Flood Insurance in Florida?

Many homeowners make the mistake of thinking that their homeowner’s policy will protect them in the event of flood damage. Before you make this error, note that damages caused by floods are not covered by standard homeowner’s policies. To protect from flood damage, you will require a flood insurance policy.

98% of US counties have experienced a flooding event. From 2014-2018, all 50 states have experienced losses due to flood or flash flood.

The average cost of flood insurance is $53 a month. If you live in a low-to-moderate risk area, your premium could be even lower!

| National Flood Insurance Protection | Coverage | Coverage | ||

| Owner occupied | Building | Contents | ||

| $371 | $100k | $40k | ||

| $389 | 125k | 50k | ||

| $415 | 150k | 60k | ||

| $453 | 200k | 80k | ||

| $480 | 250k | 100k | ||

Reasons to Acquire Sarasota, FL Flood Insurance

Florida is a beautiful state, but your property might be prone to flooding. Not acquiring flood insurance in the Sarasota area is gambling with what might be your most significant asset. According to the NFIP, more than 80% of households do not have flood insurance. Here are some compelling reasons to be on the correct side of that incredible statistic.

- Florida sits at a low elevation and is very flat. This means that when floodwaters come (and they do), they tend to spread far and wide.

- With over 8000 miles of coastline between the Gulf of Mexico and the Atlantic Ocean, rising tides put many people and properties at an ever-increasing risk of flooding.

- Florida has more hurricanes than any other state in the US. People in Florida tend to know how to be prepared for hurricanes, but they need to remember that storm damage is often worst when accompanied by flooding.

Why Insure with Harris insurance?

At one time, the only way to have flood insurance was by working with the National Flood Insurance Program. Private companies have now come on board, however. With Harris insurance, you will be able to benefit from access to 10+ private markets. More of these come on board every day, offering you the chance to be fully insured with significant savings.

Flooding has the power to destroy your home and everything in it. While insurance might not be able to replace precious, sentimental items, it can help cover your losses and help you back on your feet. Our partners include reputable Sarasota, FL flood insurance companies.

We think you might be surprised by how affordable it is to achieve a high level of flood insurance coverage, and the peace of mind that comes along with it.

We do not want anyone living in Sarasota to be unprotected from flooding. We have all seen how devastating flooding can be, and the unsympathetic, unreasoning, persistent power of water. We cannot prevent a flood from happening, nor can we turn back the tide after the event, but we can help you prepare for the worst in a way that is affordable and easy to set up.

Check Out the Details

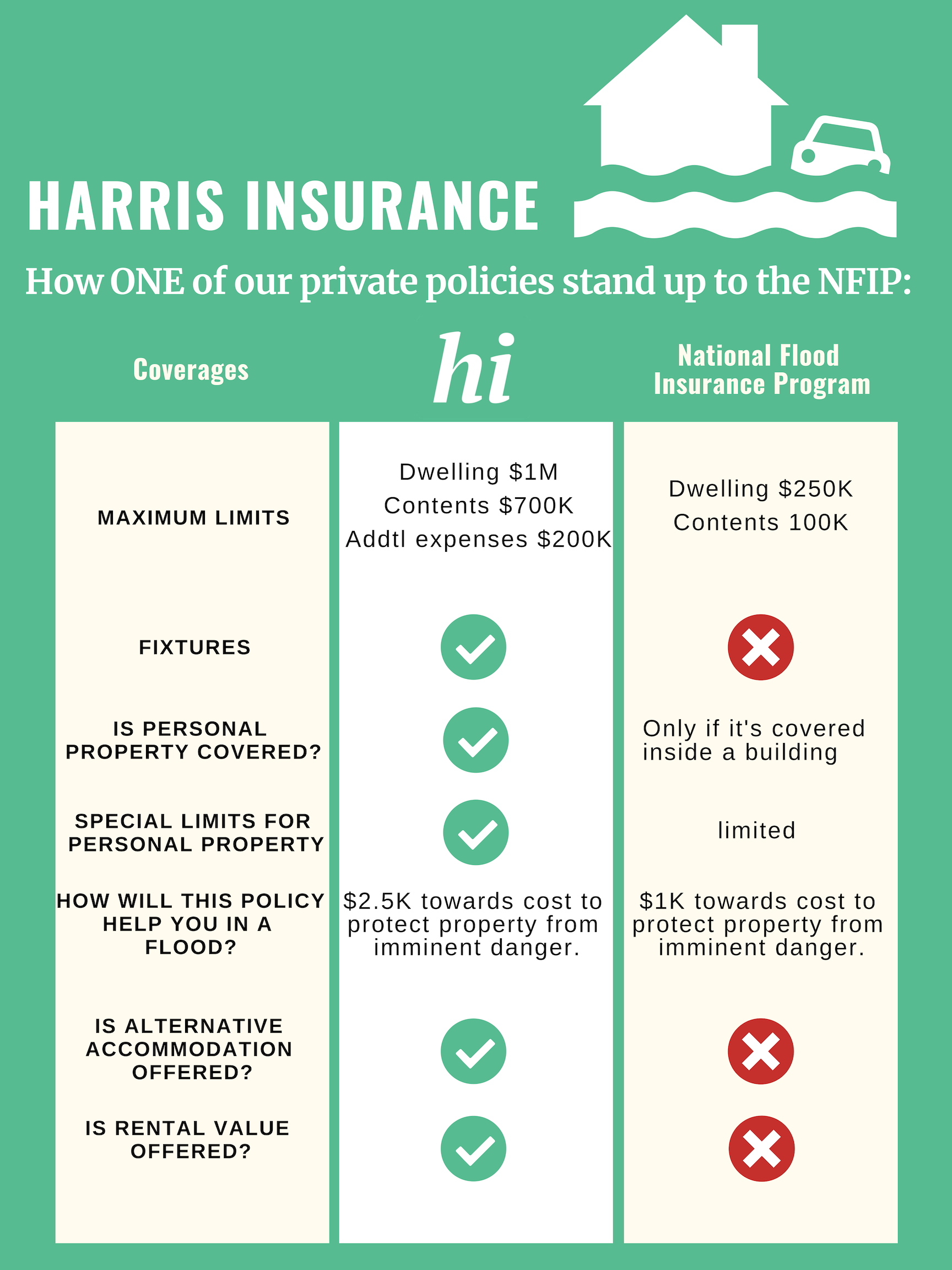

Here’s how just ONE private policy compares to the National Flood Insurance Program:

Contact Harris Insurance Today for Flood Coverage in Sarasota

If you do not have Sarasota, FL home flood insurance, or want to check your flood insurance to make sure you are adequately covered, please contact us today. Our professional and knowledgeable team is on hand to discuss your options, so you obtain the coverage you need. We can help you understand flood insurance, and how we can help you if you live in the Sarasota area.

Note that if you live in a special flood hazard area, an elevation certificate will be necessary. To acquire this, a licensed property surveyor must inspect your property. This will give you the most accurate flood insurance quote for your property.

We are experts when it comes to flood insurance in Florida, so do not hesitate to contact us. We will answer any of your questions and provide you with the coverage you need for peace of mind in this beautiful state. Flooding can happen out of nowhere, let Harris Insurance provide you with the knowledge that you are covered should the worst happen.

If your property is at risk for flooding, you need to know. You also don’t want to pay more than you have to for flood insurance. A Flood Elevation Certificate assesses your property’s flood risk and, depending on the findings, enables you to pay a lower premium for flood insurance.

As the trusted choice for Florida flood protection, we offer:

- Business Property coverage

- Business Contents coverage

- Residential Property coverage

- Residential Contents coverage

- Optional excess flood insurance for coverage limits above the FEMA federally subsidized program